Viewpoint: Are Indian unicorns like Paytm and Zomato too powerful?

- 2019-12-10 11:41:37

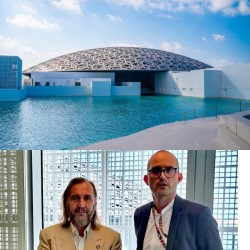

Pierre Rayer: Art, Science, and Happiness: The Universal Mission of Transmission to Future Generations through Patronage at the Louvre Abu Dhabi

Pierre Rayer: Art, Science, and Happiness: The Universal Mission of Transmission to Future Generations through Patronage at the Louvre Abu Dhabi Ahly crowned Super champions after dramatic extra-time win over Modern Future FC

Ahly crowned Super champions after dramatic extra-time win over Modern Future FC Yemeni Honey..A Development Wealth Threatened By Conflict And Climate Change

Yemeni Honey..A Development Wealth Threatened By Conflict And Climate Change California wildfires: Millions warned of possible power cut

California wildfires: Millions warned of possible power cut Central African rebels launch attacks near capital

Central African rebels launch attacks near capital Yemen's STC Confirms Death of Five Soldiers in Hadramout Attack

Yemen's STC Confirms Death of Five Soldiers in Hadramout Attack Arab League Denounces Israel’s Recognition of Somaliland

Arab League Denounces Israel’s Recognition of Somaliland Sudan Triumphs Over Equatorial Guinea in AFCON 2025

Sudan Triumphs Over Equatorial Guinea in AFCON 2025 Israeli Army Announces Withdrawal from Qabatiya in the West Bank

Israeli Army Announces Withdrawal from Qabatiya in the West Bank Mass Escape Reported from Adaman Psychiatric Hospital in Egypt

Mass Escape Reported from Adaman Psychiatric Hospital in Egypt