Should 2019 be the year you diversify to build wealth

- 2019-01-15 18:47:47

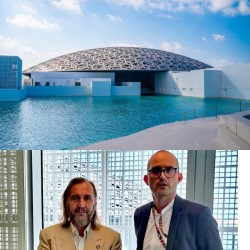

Pierre Rayer: Art, Science, and Happiness: The Universal Mission of Transmission to Future Generations through Patronage at the Louvre Abu Dhabi

Pierre Rayer: Art, Science, and Happiness: The Universal Mission of Transmission to Future Generations through Patronage at the Louvre Abu Dhabi Ahly crowned Super champions after dramatic extra-time win over Modern Future FC

Ahly crowned Super champions after dramatic extra-time win over Modern Future FC Yemeni Honey..A Development Wealth Threatened By Conflict And Climate Change

Yemeni Honey..A Development Wealth Threatened By Conflict And Climate Change California wildfires: Millions warned of possible power cut

California wildfires: Millions warned of possible power cut Central African rebels launch attacks near capital

Central African rebels launch attacks near capital Jordanian Aid Convoy of 13 Trucks Arrives in Yemen

Jordanian Aid Convoy of 13 Trucks Arrives in Yemen Australia: 11 killed in shooting at Sydney's Bondi Beach

Australia: 11 killed in shooting at Sydney's Bondi Beach Two dead, several injured in mass shooting at Brown University in US

Two dead, several injured in mass shooting at Brown University in US UK economy unexpectedly shrunk before Budget

UK economy unexpectedly shrunk before Budget Syrian Interior Ministry Clarifies Identity of Attacker in Joint Patrol Incident Near Palmyra

Syrian Interior Ministry Clarifies Identity of Attacker in Joint Patrol Incident Near Palmyra