Saudi bonds to join JPMorgan index in $119B Gulf addition

- 2019-01-19 18:16:47

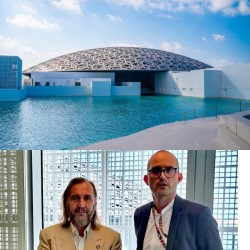

Pierre Rayer: Art, Science, and Happiness: The Universal Mission of Transmission to Future Generations through Patronage at the Louvre Abu Dhabi

Pierre Rayer: Art, Science, and Happiness: The Universal Mission of Transmission to Future Generations through Patronage at the Louvre Abu Dhabi Ahly crowned Super champions after dramatic extra-time win over Modern Future FC

Ahly crowned Super champions after dramatic extra-time win over Modern Future FC Yemeni Honey..A Development Wealth Threatened By Conflict And Climate Change

Yemeni Honey..A Development Wealth Threatened By Conflict And Climate Change California wildfires: Millions warned of possible power cut

California wildfires: Millions warned of possible power cut Central African rebels launch attacks near capital

Central African rebels launch attacks near capital Israel Officially Recognizes the Republic of Somaliland as an Independent State

Israel Officially Recognizes the Republic of Somaliland as an Independent State Saudi warplanes strike STC sites in south Yemen's Hadramout

Saudi warplanes strike STC sites in south Yemen's Hadramout Saudi Arabia Calls For End Of Escalation In Southern Yemen

Saudi Arabia Calls For End Of Escalation In Southern Yemen Phase two of Israel Gaza ceasefire to begin in days

Phase two of Israel Gaza ceasefire to begin in days EU Reaffirms Commitment to Yemen’s Unity, Urges De-escalation

EU Reaffirms Commitment to Yemen’s Unity, Urges De-escalation